As a truck driver or owner-operator, your responsibilities go beyond simply driving from point A to point B. One of these essential responsibilities is making sure you have the right insurance coverage to protect your truck, cargo, and yourself. The trucking industry plays a critical role in transporting goods and materials, making it necessary to have the proper insurance in place to reduce financial risks and ensure smooth operations. In this blog post, we will explore the different types of insurance coverage for owner operators that should be considered to stay protected on the road.

Liability Insurance

Every truck driver needs liability insurance, as it covers you in case of an accident where you are found to be at fault. This type of insurance typically covers bodily injury and property damage caused to others. As a trucker, the law requires you to carry a minimum amount of liability insurance. However, we recommend obtaining coverage beyond the minimum required levels to protect yourself adequately from potential financial liabilities.

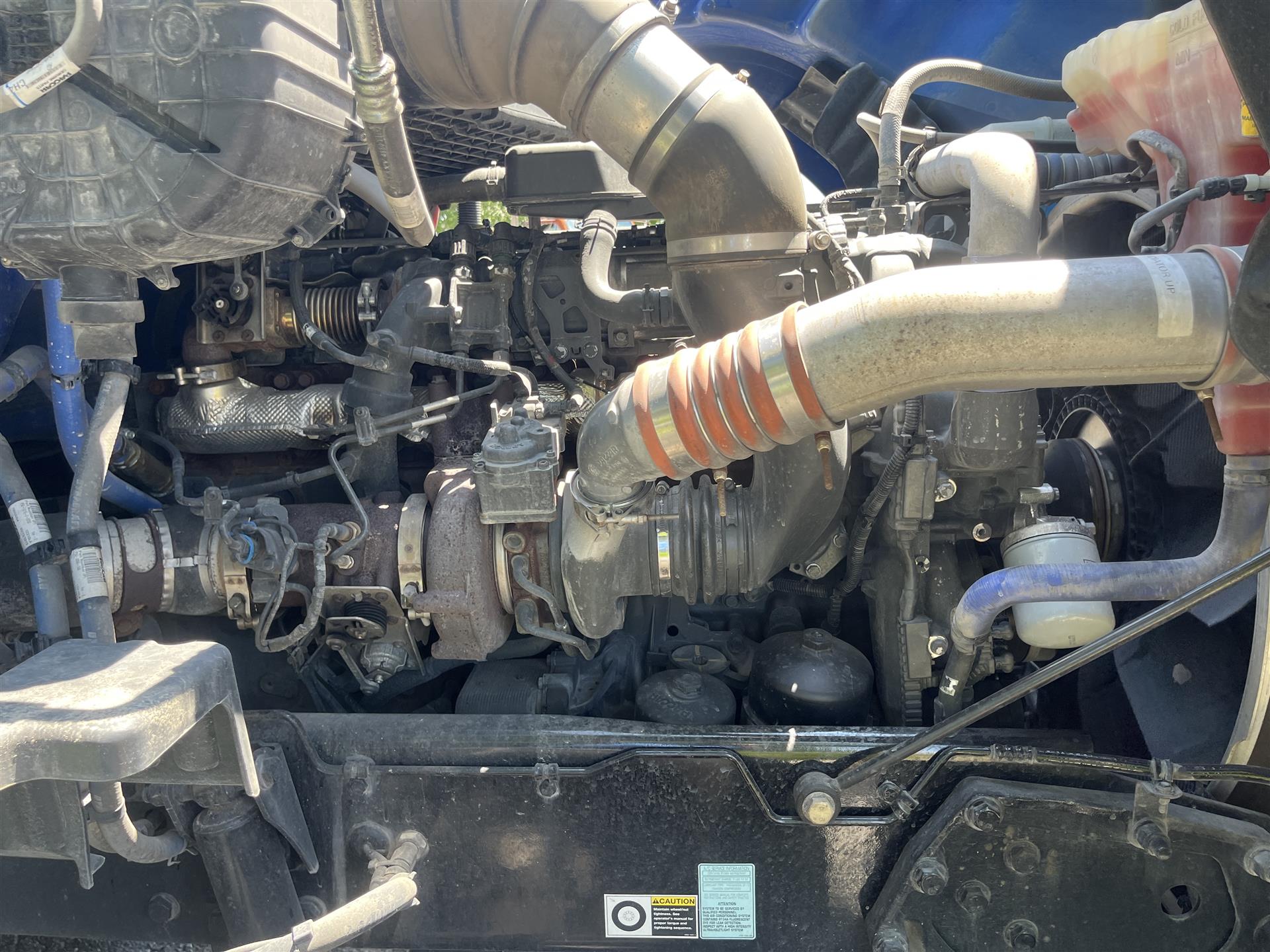

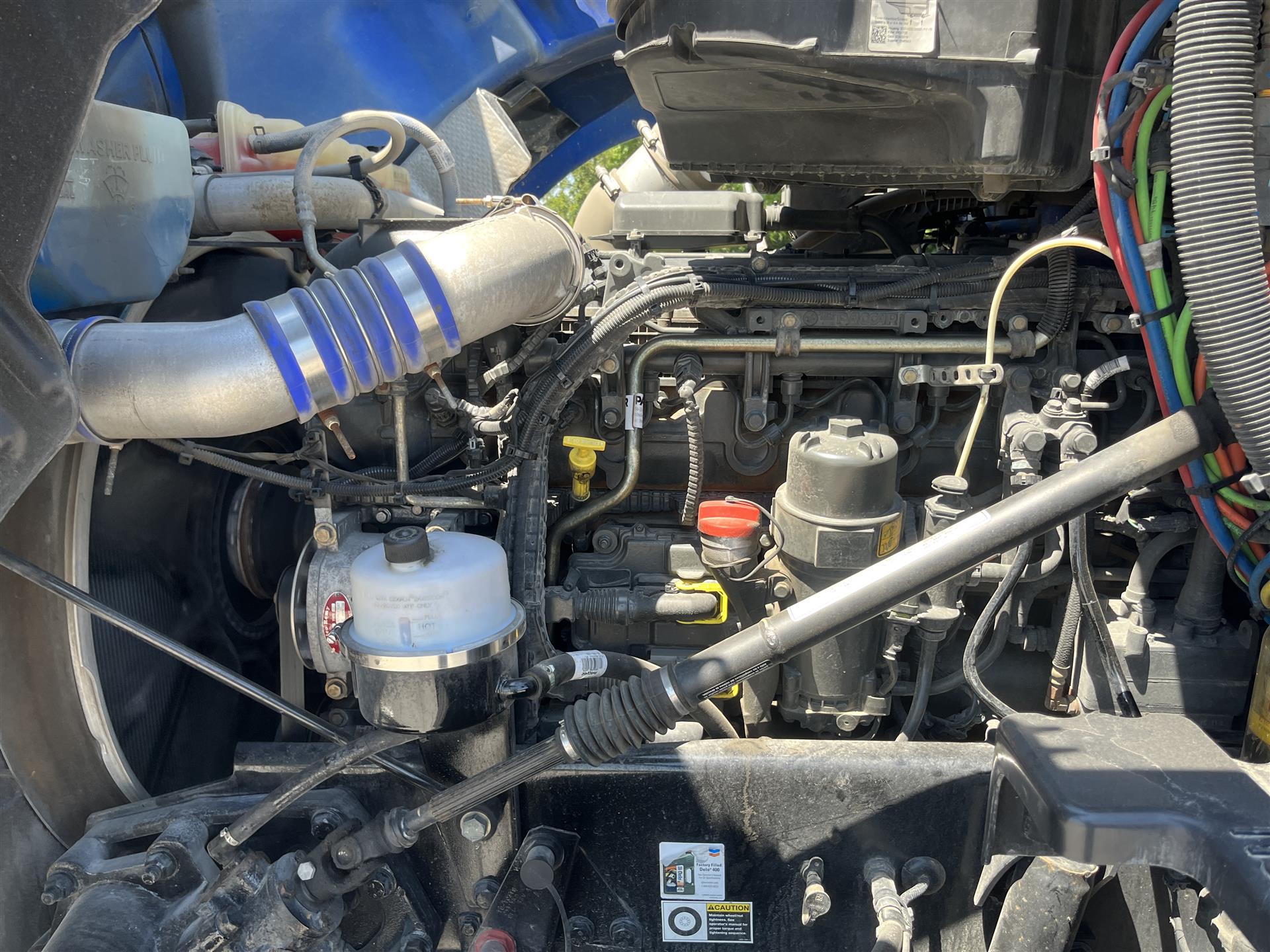

Physical Damage Coverage

Physical damage coverage encompasses both collision and comprehensive insurance, which protect your truck in case of accidents or other unforeseen events. Collision insurance covers damages to your truck in case of a collision with another vehicle or object, while comprehensive insurance covers damages caused by events such as theft, vandalism, fire, or natural disasters. Having physical damage coverage ensures that you can repair or replace your truck quickly if needed, keeping your business running smoothly.

Cargo Insurance

Cargo insurance is another critical type of coverage for truckers, as it covers the goods you transport. This insurance will protect you if the cargo suffers damage, loss, or theft during transportation. Various cargo insurance policies offer different coverage levels, so it’s essential to choose a policy that covers the value of the goods you transport adequately. Keep in mind that some shippers may require specific cargo insurance coverage as a condition for working with them.

Additional Insurance Options to Consider

Besides the core insurance coverages mentioned above, truck drivers should consider a few additional options:

- Non-Trucking Liability Insurance: This coverage protects you when you use your truck for non-business purposes, such as running personal errands or taking a vacation.

- Bobtail Insurance: This insurance covers you when you drive your truck without a trailer, whether for business or personal use.

- Occupational Accident Insurance: This coverage helps pay for medical expenses and lost wages from work-related injuries.

- Uninsured/Underinsured Motorist Coverage: This insurance protects you in the event of an accident with a driver who lacks sufficient insurance to cover the damages.

Securing the right insurance coverage is a critical aspect of running a successful trucking business. As a truck driver, you must ensure that your truck, cargo, and yourself have adequate protection. By investing in liability insurance, physical damage coverage, cargo insurance, and additional insurance options, you can reduce financial risks and enjoy peace of mind knowing that your livelihood is safe. Always consult with an insurance professional to determine the best insurance coverage for owner operators to fit your specific needs and requirements.