Commercial trucking insurance is a crucial part of the business for carriers and independent owner-operators. Trucking insurance is a significant expense and can reduce the bottom line of the profitability of a trucking business. It’s important to understand what coverage you have and what coverage you need. Suppose you don’t understand your commercial trucking insurance policy, in that case, there’s a good possibility you could end up with more endorsements than you need. Alternatively, be sure you’re not underinsured.

Trucking Insurance Language

Understanding the terminology and the basics of commercial truck insurance will help when planning and organizing coverage. Commercial trucking insurance policies cover damage and loss in several situations, including damage to the semi-truck, trailer, load/cargo, other vehicles, other semis, trailers, and cargo/property damage.

Liability: covers any damage to other parties involved in an incident, including your own.

Cargo: covers the costs involved to damaged or stolen goods hauled in a trailer.

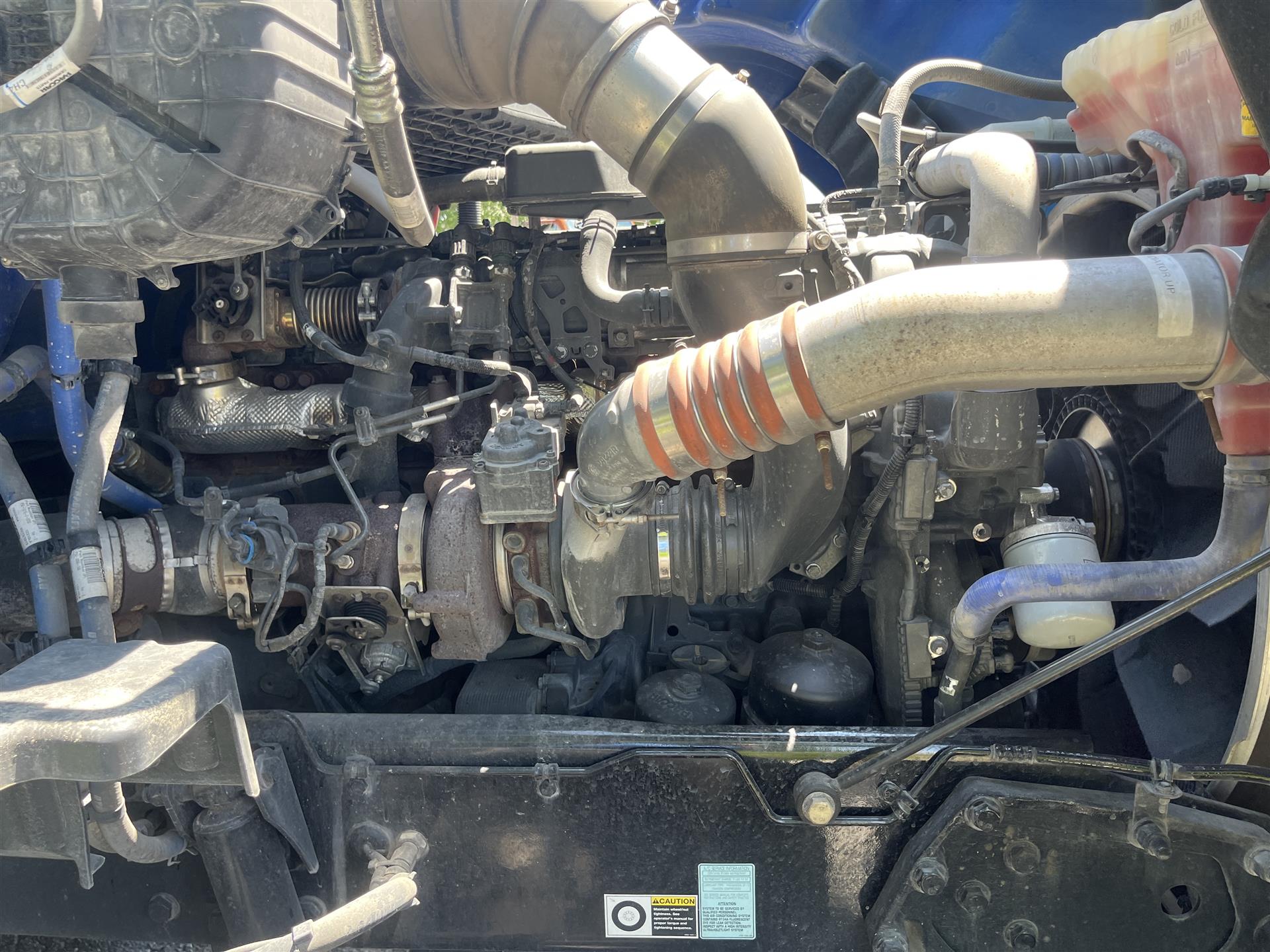

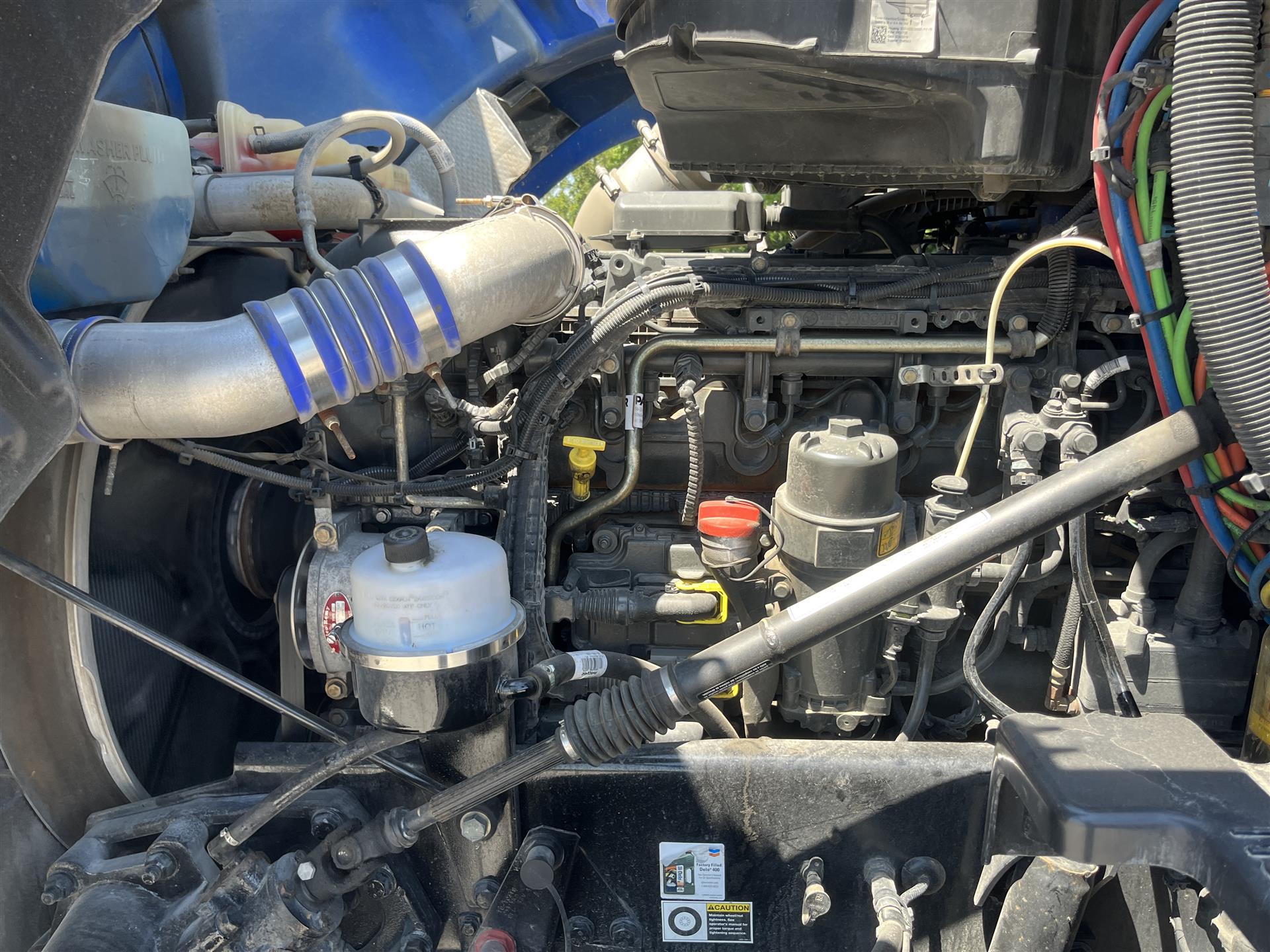

Physical Damage: covers damage to equipment from various causes, such as collision damages and weather related incidents.

Bob Tail: this coverage is highly recommended for all commercial trucks, especially owner-operators who take their trucks home when they’re not on the road.

Reefer: covers damage done by reefer motor failure, but not reefer motor repairs.

Paying Premiums

The cost of a policy for commercial trucking insurance can be extremely high. BUT, it’s possible to finance your policy through a finance company. Those finance companies add on an interest cost of the policy, while being able to structure a payment plan suitable for their client. In some cases, other finance companies will divide the policy’s total cost into 12 equal payments with minimal interest charges or a one-time fee.

Be sure you’ve budgeted to ensure that you’re for the right insurance policy. Knowing what and how much coverage you need is something an educated insurance broker can help with. They will typically design a commercial trucking insurance plan suited to your needs and within your budget.