If you want to become an owner-operator, there are many different things to consider. You may ask yourself, “do I want to become a lease-purchase operator?” If you’re not financially able to buy a semi, leasing a semi-truck is one of the best decisions you can take at the beginning of your owner-operator career. Below are multiple benefits of leasing a semi-truck:

Lower Upfront Costs

Buying a new or used semi-truck can require a significant cash investment. Even if you are approved to purchase, the down payment can cause unexpected cash flow issues, especially for a new start-up business. Leasing a semi-truck requires a lower down payment when compared to buying a semi-truck.

Lower Credit Standards for Approval

Leasing is an excellent alternative to receiving a loan for a semi-truck, especially for those with less-than-perfect credit. Lessors are likelier to do business with someone with minor credit issues because they have a lower risk than banks. Although there may be less risk, a lease-purchase program does not allow a lessee to walk away from the lease before the end of the contract.

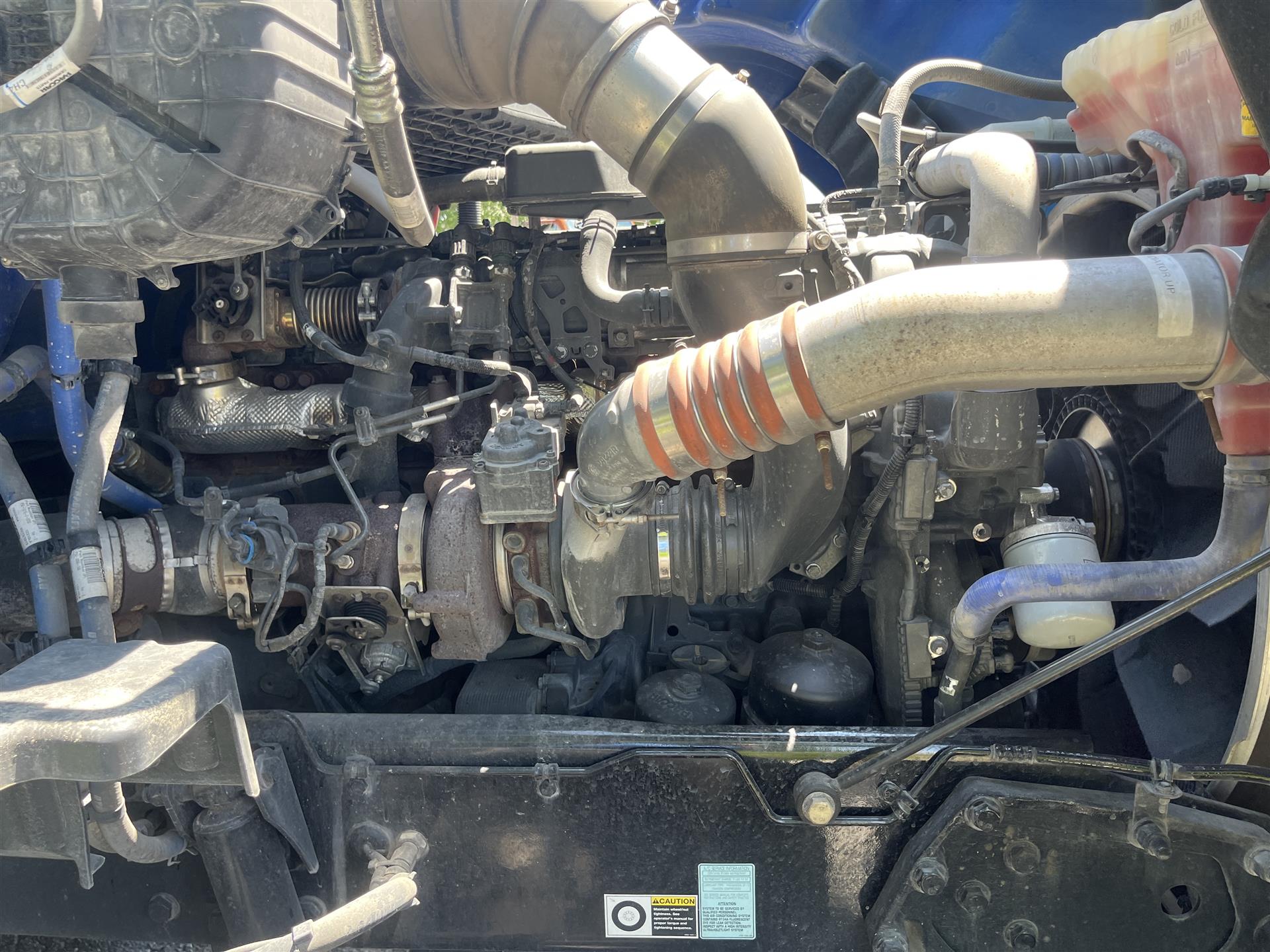

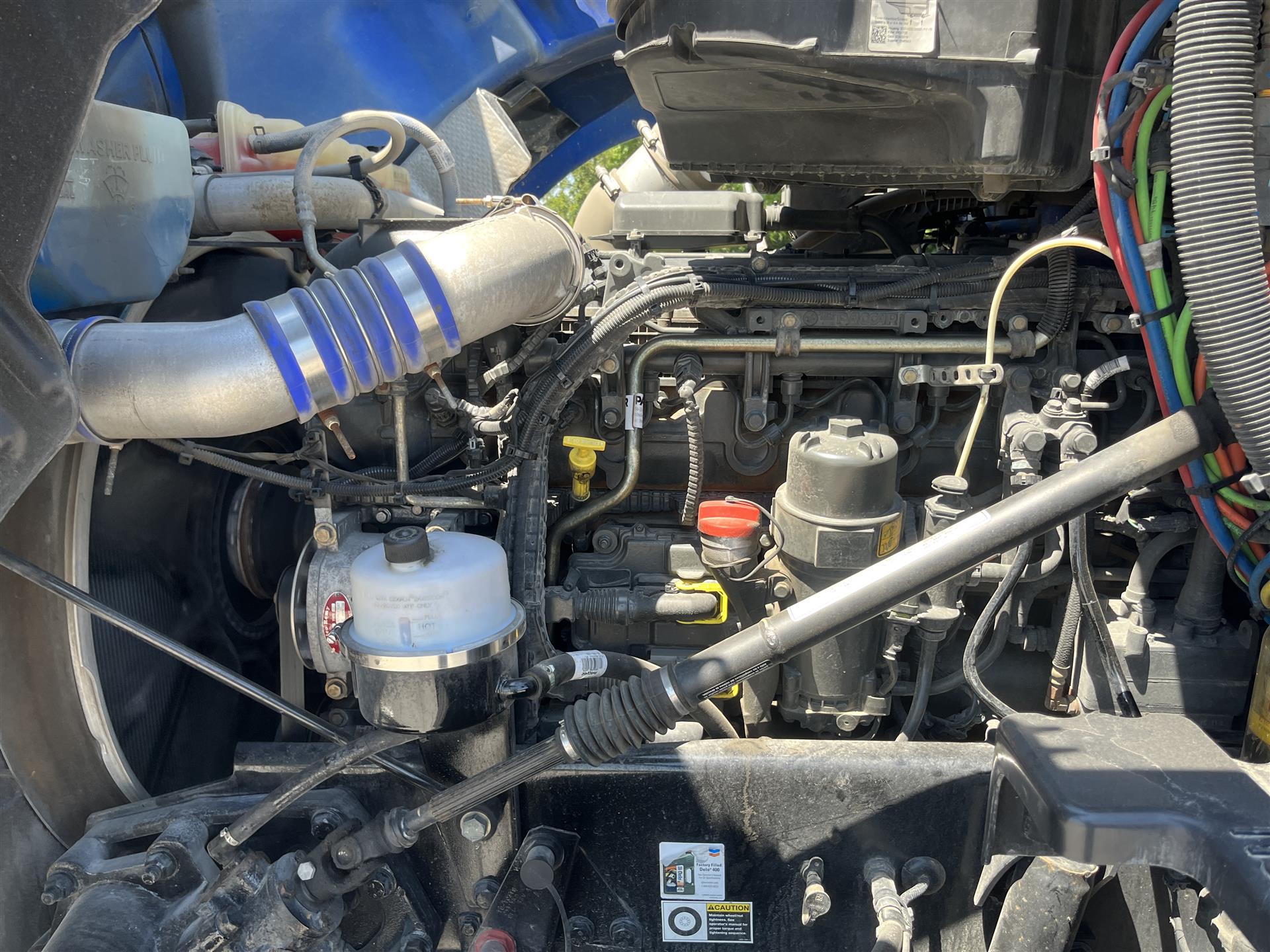

Maintenance Escrow Accounts

Every successful owner-operator has a maintenance schedule that they follow strictly. To keep a semi-truck up and running efficiently, proper maintenance is key. A maintenance escrow account is a great way to ensure funds are always available for those preventative maintenance items. Most leasing companies will require you to pay into an escrow that you have 24/7 access to.

Opportunity for Ownership

If you decide to lease a semi-truck, and your ultimate goal is to own your truck, it’s wise to do business with a company that offers a lease-purchase or lease-to-own. When committing to a lease-purchase contract, ensure you understand all lease terms and stipulations. Most companies require a balloon payment after your final lease payment. Once that fee is paid, the truck is yours!

Flexible Revenue Opportunities

Whether you want to run under your own authority or sign on with a carrier, both are great options. If you want freedom as a lease-purchase operator, find a company that has no carrier restrictions or allows you to run under your own authority. It’s wise to have a solid business plan before you become a lease-purchase operator.

Tax Advantages

Leasing a truck instead of buying it allows you to mark its use as a general business expense rather than the depreciation of an asset. This can make your balance sheet look more attractive to potential lenders to expand your business while also allowing you to claim annual tax deductions.

Truck drivers can choose from lease programs all over the country. Some programs might fit your business goals better than others. Make sure you have a complete business plan before making the leap to become an owner-operator.